A response to the environmental cost of crypto art by artists, activists and theorists.

“The Uncanny Valley” is Flash Art’s new digital column offering a window on the developing field of artificial intelligence and its relationship to contemporary art.

The recent publication of Memo Akten’s research into the ecological cost of the crypto art industry has fostered a new debate, indeed a whole new politics, of art on the blockchain. Training his focus on the market for NFT art — which offers verifiable digital scarcity and proof of ownership in the form of non-fungible tokens (NFTs) — Akten revealed that the carbon footprint of an average single-edition NFT is equivalent to driving a petrol car for 1,000 kilometres. He also highlighted how, for higher editions, the figures are equivalent to dozens of transatlantic flights. These findings have checked the optimism associated with the crypto art marketplace as a halcyon space liberated from old gatekeepers and intermediaries — the ultimate free market. A state of innocence it is not.

But it is also an opportunity. Led by Akten’s example, Flash Art has sought to establish how both the market for NFT art and the blockchain more broadly might serve to cultivate a less destructive ecosystem. To achieve this, Alex Estorick and Beth Jochim canvassed a group of specialist artists, activists, and theorists for their visions for a space that is at once fertile terrain and a new battlefield.

Together, their contributions represent a hybrid manifesto whose internal conflicts reflect the present struggle toward a new ecology of crypto art.

Memo Akten: It is incredible that for the first time ever, digital artists are able to sustain a living making the work they love. But since the NFT market has reached a stage where tweets and screenshots are tokenized for laughs, I was curious about the carbon footprint of these activities. It is known that proof-of-work (PoW) blockchains consume a lot of energy, but there is currently no information available for NFTs. I started looking into this out of curiosity, without plans to make my findings public.

However, as I calculated the figures — of orders of magnitude higher than other typical online activities — I realized that the issue of sustainable platforms not only needs to be part of the crypto conversation, it is the conversation — into which systems, functional applications, and power structures are all enmeshed.

When I began sharing this information in September 2020, it was mostly ignored, but at least one crypto artist, Joanie Lemercier, was prompted to seek more information from the platform he was working with. After months of inquiries, trying to understand the impact of his release, all that he consistently heard back was “we will check with the team and get back to you.” Despite his attempts to reduce his studio’s electricity consumption every year, it turned out his NFT release had consumed in ten seconds more than his entire studio over one and a half years.

This is unacceptable. Providing even ballpark figures and advice regarding one’s ecological impact should be compulsory for these marketplaces. It is clear a more radical approach is needed to get people’s attention and provoke discussion, which prompted my website and Medium article. I have since been approached by another crypto artist regarding their own footprint, which was more than one hundred tons of CO2. (To put this into perspective, across Europe and the US the annual per capita carbon footprint of all industry, trade, and imported goods is on the order of ten tons of CO2.)

Of course even these figures — and one individual’s actions — are a drop in the ocean of global emissions. Of course we need to decarbonize our energy production (including next-gen nuclear) and invent new, negative-emission carbon capture and storage technologies. But at best these are going to take decades to emerge, test, and deploy globally. In the meantime, our emissions are not only not decreasing, they are increasing (excluding lockdown-related decreases in 2020). We need a radical shift in mindset.

Research into new technologies (including blockchain) is essential. But this has to follow a conscious, less extractivist model. I welcome the fundamental research happening in this space, but there is no doubt that the recent rapid growth of the NFT market exemplifies Silicon Valley’s move-fast-break-things accelerationism. If this were not the case, more ethically aligned platforms might have included ecological statistics on their sites, alongside sales and ROI data. They might even be providing advice and caution. As Christina Akopova, cofounder of crypto art platform Pixeos — on the DPoS-based EOS blockchain rather than Ethereum — notes: “If you don’t buy the #cryptoart you like cause it’s not on ETH, you are basically an ETH tokens collector, not an art supporter.”

If profit is going to be the primary motivation for growth and research, then one of our strategies must be to make it more profitable for businesses to act responsibly.

Unfortunately, this kind of social pressure remains essential for corporate social responsibility. Planned since 2014, ETH 2.0 uses “proof of stake” (PoS) to make it more efficient by several orders of magnitude. (It is also essential for scalability and business, as evidenced by skyrocketing gas prices.) ETH 2.0 is currently being tested, (hopefully) to be rolled out for mainstream use in the next year or two. While (hopefully) this will resolve the energy problem, it does not address the larger issue. Given the constraints imposed on us by global warming, we have a severe problem if we cannot discuss the issues of today because we hope they will be resolved “in a year or two,” and if we acquiesce to businesses and platforms operating in this manner. Because if we don’t hold them accountable as artists and citizens, then who will?

Digital artists absolutely should be able to earn a living making the work they love. But this should not involve the immense footprint it does presently nor the current lack of transparency. New businesses and platforms must align with the values we are hoping to carry into the future. I released my initial article in the hope that it would start a much-needed conversation during this frenzied period of growth. I now hope it can continue in a productive direction, that we can avoid the violent accelerationism of the past and instead plot our course forward in a sustainable manner.

Alice Bucknell: True to crypto’s inaugural mission back in 2008, blockchain-based online art marketplaces cut out the middleman and now offer artists a more intimate and direct relationship with buyers. As a distributed record of transactions, the blockchain creates transparent histories of ownership, sale prices, and present locations of all tokenized artwork, while potentially bolstering artists’ resale rights. Blockchain technologies have also enabled new forms of shared ownership that are more accessible for younger, less-deep-pocketed collectors.

Yet these new marketplaces are fatally flawed. The leveraging of an artist or artwork into a speculative investment scheme is underpinned by neoliberal techno-politics.

As Satoshi Nakamoto noted in his “white paper” guide to Bitcoin, published in the heat of the global recession in early 2009, cryptocurrency “encod[es] aspects of a libertarian understanding of money, power, and economics … but [is] born out of a network strategy to circumvent authority through the use of a decentralized architecture.” Crypto has never reconciled its socialist blockchain fantasies with its current application as yet another avenue for speculative finance. Crypto advocates need to work through that paradox if the new system is to avoid perpetrating old exploitative operations.

Alice Bucknell, Swamp City, 2021. Single-channel HD video. Courtesy of the artist.

In evaluating crypto’s emancipatory premise, we must also address its devastating environmental impact and its reinforcement of destructive anthropocentrism. The “mining” of cryptocurrencies uses vast amounts of fossil fuel–derived energy — Bitcoin alone ate up more power than that of a small country in 2016, and that figure quadrupled in 2018. Artists like Ed Fornieles and Ami Clarke investigate the political and ecological stakes of crypto through live action role-play and virtual reality–based interactive artworks. Their work offers a much-needed social context while picking apart crypto’s techno-patriarchal profit-seeking model.

Conceived in lockdown, my video E-Z Kryptobuild (2020) uses speculative fiction and the seductive visuals of celebrity architecture to critique the neoliberal aesthetics of crypto culture. Here, Fyre Festival-style schadenfreude meets flashy yet retro CGIs envisioned by the Seasteading Institute. As autonomous artificial islands run, tax-free, on the blockchain, seasteads arguably represent the architectural sublimation of libertarian wet dreams.

E-Z Kryptobuild delivers a satirical narrative promising luxury escapism from impending environmental apocalypse to the highest blockchain bidder.

Working toward an aesthetic philosophy of crypto art, there is a clear divide between the pixelated nostalgia of CryptoPunks in 2017 — the first NFT artwork sold on a blockchain — and art made about blockchain technologies — including the work of Sarah Friend and the Dutch design studio Metahaven. The former is retrograde, reifying its own subcultural identity in 8-bit exceptionalism; the latter shoots a speculative crypto-ecology through an interdisciplinary web of politics, society, environment, and economy. As a type of world-building, my current project Swamp City (2021) visualizes the ecological impact of crypto by merging its utopian and dystopian facets inside an interactive game engine environment.

Geert Lovink: The thesis here is that we should consider cryptocurrency as an essential new layer of the expanded artwork. This requires separating the technical possibility of generating and storing unique (and thus scarce) digital artworks from the question of price, currency, and method of payment. As Memo Akten has shown, the current model of storing digital works of art on a blockchain is utterly unsustainable.

From the perspective of the artist, what is most urgent is not so much a marketplace or blockchain but a peer-to-peer payment system that requires the fewest possible intermediaries, one based on public standards without being subject to corporate or state control.

The crypto cult is now too much of an end in itself, ruled by an invisible “pump ‘n’ dump” mob whose marketplace is fertile terrain in which to funnel “funny money.” After a decade of cloistered currency and token speculation it’s time to focus on the user rather than cultivating more toxic masculinity and the hoarding of “digital gold.” Instead artists and cultural workers urgently need new revenue models to underpin their practices. In the debates of our MoneyLab network, founded in 2013, we have always stressed the importance of additional forms of income in order to fight mass precarity across the world of creative work.

Yet the magnitude of possibilities is also exciting, and this is why so many young people are involved. We all feel we’re part of an alchemical movement aiming to redefine money with the potential for a radical redistribution of wealth.

But unless the crypto art community addresses this issue explicitly, it will be complicit and a victim, destined to stand by as money moves on and either solidifies into real assets or evaporates. If you’re not part of the dark web, crypto tech is not delivering. Unless crypto starts to sabotage its own speculative dream machines, things will inevitably collapse, regardless of the “democratic” promises of the meme swarms. Right now, the crypto business is anything but decentralized, dominated as it is by racist right-wing techno-libertarians. Unless this is properly addressed, nothing will move on, certainly not in the art world.

At present, contemporary art has virtually no connection to the crypto art world, while artists like Simon Denny — who address the politics of blockchain — are rare. However, I won’t be surprised if we see NFTs proliferating in upcoming biennials if only to satisfy the post-COVID financial imagination. Whether the commercial art market will relocate over the long term is unclear. In all likelihood, we can expect the rise of parallel art worlds with minimal interaction. What distinguishes crypto art is its overall retrograde aesthetic, characterized by animations copy-pasted from American sci-fi films and comic book fiction projected into today’s gamer-geek culture. On the one hand, we should respect its untimely weirdness. But we should also challenge the genre to become even more weirdly contemporary. Why seek out a distant future only to land in 1970? Crypto art reflects an unreconstructed desire to return to a pre-Reagan revolution, when psychedelia was still a viable means of overcoming the narcissistic self.

Instead of rewarding retromania we need to do-over the crypto-social imaginary in order to confront our messy present.

Primavera De Filippi: The crypto art movement is blooming. Since CryptoPunks emerged back in June 2017, the use of a blockchain to collect digital artworks has grown exponentially. Initiatives such as Monegraph, Ascribe, and Verisart first explored the use of blockchain technology to establish the provenance and authenticity of artistic works. Today, blockchain-based online marketplaces like SuperRare, Rarible, and OpenSea offer a new mechanism for artists to sell works directly to the public without relying on galleries, intermediaries, or other third parties. Blockchain technology has also introduced artificial scarcity into the digital realm by pairing digital works with blockchain-based non-fungible tokens (NFTs) that cannot be forged. These platforms have thus enabled artists to sell “tokenized” versions of digital artworks, while preserving their unicity and authenticity.

While a growing number of new artists are currently leveraging this technology to sell digital artworks online, the crypto art movement is also receiving growing criticism.

Many consider that the combination of art and cryptocurrencies does not qualify as a new art movement so much as a new medium for art’s sale and speculation, indeed one which replicates the very system it was originally intended to disrupt. Others have criticized it for the considerable energy costs and ecological damage that are folded into the new medium.

Yet many artists are not using blockchain technology to distribute their artworks, but rather as a means to create new artworks that would not otherwise be possible. In 2014, Carmen Weisskopf and Domagoj Smoljo, otherwise known as !Mediengruppe Bitnik, introduced the Random Darknet Shopper, an ongoing artistic project whereby an automated shopping bot uses Bitcoin to purchase random products from the darknet which are then delivered directly to a physical exhibition space. Their goal was to show how cryptocurrencies might afford bots a greater degree of autonomy in managing money.

In 2015, I created the first Plantoid, a mechanical plant-like creature that feeds on cryptocurrencies to pay artists to proliferate new instances of itself. The project thus leverages blockchain technology to explore a new business model for artistic production, with funds controlled not by an artist but by the Plantoid’s soul, taking the form of a smart contract on the Ethereum blockchain. Likewise, in 2017, Paul Seidler, Max Hampshire, and Paul Kolling launched Terra0, an initiative that uses blockchain technology to help a forest thrive and grow, accumulating capital by selling its own resource (wood) in order to expand its territory through the purchase of new land. Here, the focus is not on the use of blockchain technology as a medium of exchange, but rather the technology’s potential to confer greater autonomy on the work of art.

All the fuzz surrounding crypto art conceals the real potential of blockchain technology for an art world presently shaped by its intermediaries.

While the risk exists of further reinforcing neoliberal circuits of speculation, a number of artists are revealing the blockchain as a revolutionary ecosystem in which self-replicating “autonomous” art can flourish independently from its original creator.

Jason Bailey: The ~$65 billion art market is one of the most centralized markets in the world. A tiny number of artists with early access to just a handful of high prestige institutions have twice as many exhibitions as artists without access and are traded 4.7 times more often at auction, at a maximum price 5.2 times higher.

Sadly, if you are not born in one of the few countries with a high-prestige institution, you have a near zero chance of being successful in the traditional art market. And being born in a country with prestigious institutions is also no guarantee you’ll get a fair shot at success. If you are a woman or an artist of color, the odds are still dramatically stacked against you: 96.1% of artworks sold at auction are by male artists; there are no women in the top 0.03% of the auction market, where 41% of the profit is concentrated; and 80% of the artists in NYC’s top galleries are white (and nearly 20% are Yale graduates).

Regardless of artistic skill, most artists have no statistical chance of success in the traditional art market because of a combination of factors outside their control, namely gender, race, and geography.

This is especially challenging for artists during the pandemic when those already struggling to make ends meet have been rendered even more economically vulnerable.

A group of us decided several years ago that rather than trying to reform a conservative, centralized art world built on exclusivity, we would try to build a new inclusive art market based on the inherent decentralization of blockchain technology. The timing was good. In 2020 the traditional art market — underpinned by the emissions of thousands of people flying to art fairs — shrunk during travel restrictions. Combined annual revenue from public auctions fell by 30% at the top three auction houses in 2020. Meanwhile, our new art market open to everyone and built on NFTs (non-fungible tokens) experienced exponential growth. It’s still early and there are some worrying signs we are at risk of replicating the star system of the old art market. But for many talented artists around the world, NFTs mean they can feed their families and pay their rent by selling their work.

My friend Memo Akten recently did our community the service of pointing out the inefficiency of NFTs. As a team of solution-oriented builders working on a more equitable art market, we have taken this to heart. I am personally bootstrapping a bounty to be paid for innovative solutions to improve NFT efficiency in the short and medium term. In the long term, NFTs will move from the energy inefficient process of “proof of work” (PoW) to a more eco-friendly process called “proof of stake” (PoS). This paradigm shift will reduce energy consumption of NFTs by 99%.

Most technologies start off inefficiently and improve over time.

Exchanging some limited short-term inefficiency in the NFT process to build a new decentralized art market in which hopefully everyone can participate and nobody needs to fly anywhere or ship and store art seems like a fair trade-off. If you’d like to participate in building a new decentralized art market and/or in improving the efficiency of NFTs, I am available to chat on Twitter @artnome.

Chloe Diamond: In the last year, crypto art has evolved into a whole new beast, allowing artists to manage the distribution of their art through smart contracts and novel brand strategies. Forthcoming “drops” are announced on social media, while jargon and memes are optimized in order to hype the work and boost its value. With social media and artist-led initiatives comes the desire for common creation and community participation, blurring the roles of artist and audience. Now, thanks to the blockchain, artists and other creative workers can collaborate on live artworks through the DADA platform, or on “programmable art” layers on Async Art.

Whereas authorship and authenticity still underscore the legal architecture of the traditional art world, crypto artists control creation, promotion and, to an extent, price. They can also determine their role in a piece over the course of its lifetime.

The multidisciplinary background of most crypto artists works in their favor. Uninhibited by canonical aesthetics (though curiously prone to Koonsian conceits) the entry barrier is minimal, offering all cultural workers — regardless of background — the potential to find success and financial stability through their art. The current problem is a lack of discourse and conceptual depth. Without a clearly delimited frame, the crypto art space is vulnerable to the neocolonialism of the “legacy” art world, whose perpetual recycling of styles and avant-gardisms secures its status as a prototypical money laundry. For the moment at least, the traditional art world is struggling to reconcile crypto art with its broader ecosystem. At the Museum of Contemporary Digital Art (MoCDA), we are working to ignite discussions around digital art through curatorial insight, exhibitions, events, and education. This is in order to define new metrics with which to appraise crypto art while seeking fruitful collaboration with the contemporary art world.

The pandemic’s enforcement of digitization has already reshaped the way we communicate, in the process flattening the experience of all forms of digital art into one metaverse.

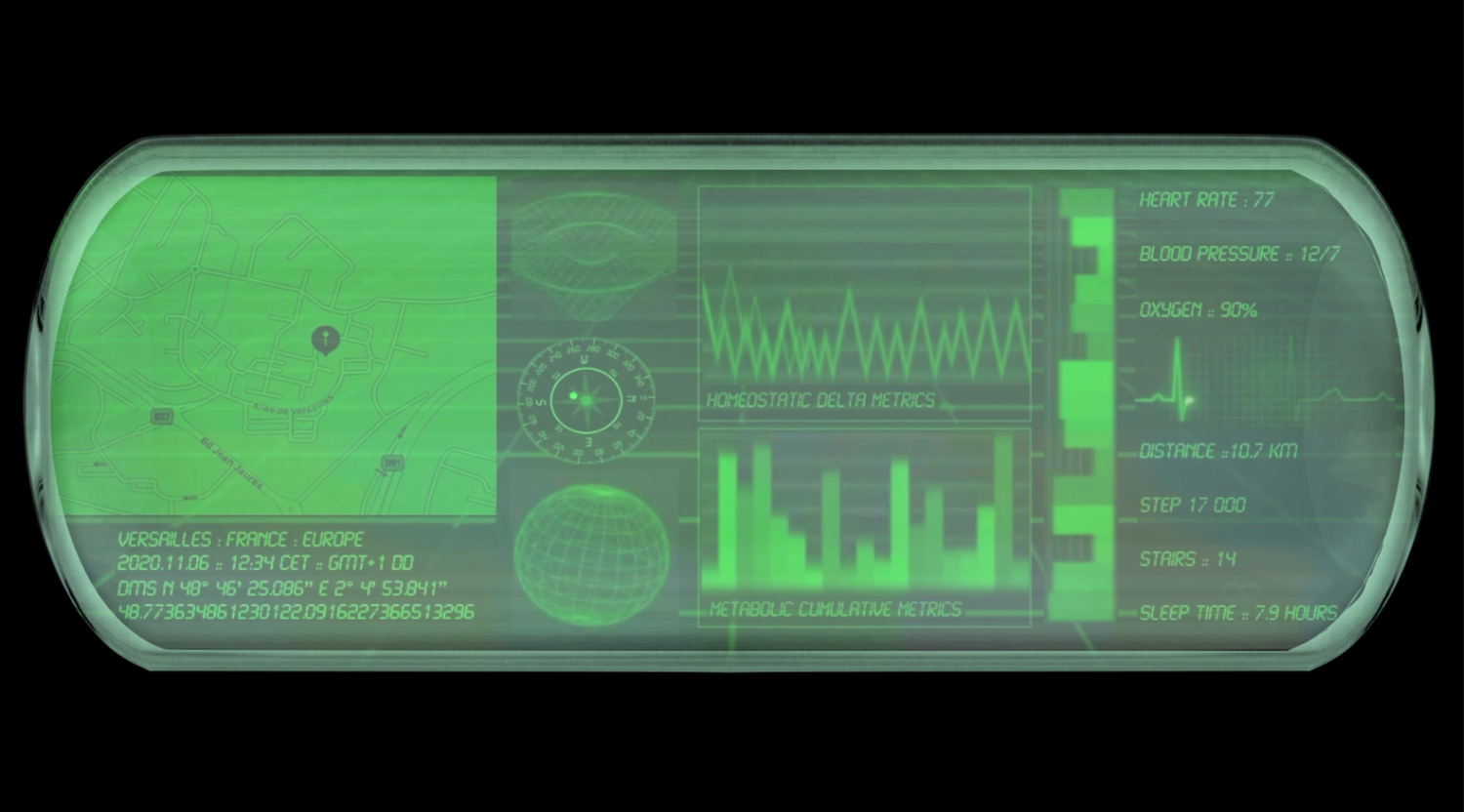

Yet the influence digital technologies have on us, both in virtual realms and on our physical bodies, is still to be fully explored. Crypto art holds a mirror to the way we navigate our digital environment, defining tender topics in an attempt to cultivate a more critical approach to our future. In Lans King’s This is my body (of work) (2019-21), a chip containing a private cryptographic code representing the artwork is implanted into the artist’s hand. King has recently integrated an NFT into the project, titled I am an NFT, exclusively for the purpose of tracking his location and health data using a biosensor wristband. This adds a performative dimension to the emergent NFT phenomenon, resituating the artist’s body within new circuits of distribution on the blockchain. It also invites the audience to consider such new technologies as prosthetic extensions of an expanded ‘body’.

MoCDA’s current exhibition, “Abstract Art in the Age of New Media,” considers how the brain relates to space in a virtual environment and whether that influences the experience of viewing art. The relationship between audience and artwork in digital spaces is evocative of Benjamin’s reflections on aura. How is the experience of being with an artwork changed when it is shorn of physical materiality? Is it necessary to experience digital art via an avatar in order for it to resonate? Virtual settings like Cryptovoxels and Somnium Space allow us to realize our sci-fi dreams through the limitless immateriality of the digital. They also offer at least the image of a sustainable technological future.

Casey REAS: The beautiful idea of networked, digital art is that everyone can have access to it all of the time. The art comes to me through the network, wherever I am, no matter who I am.

The gallery is any web browser, running on any computer, anywhere in the world. There’s no scarcity, the work can be copied perfectly and transferred without friction through the networks. Everything we understand about scarcity and value is different with digital art. There’s no single, authentic copy; there are as many identical copies as are desired.

At the same time, people can still collect and own it. This is not a contradiction. Digital art is free and valuable at the same time. The collector’s value is owning the property rights to the work, and not in the power dynamics of limiting access. The collector has one thing that nobody else has — the right to sell the work. The more the work is shared, the more it gains value. It’s in everyone’s interest for the work to circulate and to be cared for. Digital art has always been accessible, but blockchains have made collecting it desirable at a large scale. Everyone on the network has access to the same information of who owns what, and none of this information can be falsified. There’s a clear line from the artist to the collector; the provenance is authentic. The idea of the blockchain is beautiful too.

The missing piece of this elegant system is the way information is verified. The computational power that verifies a proof-of-work (PoW) blockchain like Bitcoin or Ethereum is incredibly inefficient, and the energy use is staggering. Is it the artists’ responsibility to “fix” the blockchain? Will artists boycotting the blockchain change anything? Should an artist be burdened by guilt for selling work through a blockchain? All blockchains aren’t created equal and the systems that leverage them aren’t either.

It’s not an all-or-nothing proposition, but will this issue sink the ship? Should it? What are the alternatives?

Institutions and individuals have tried to support digital art for decades and nothing has worked! The art market’s embrace of digital art has slowly grown, but the impact remains small. Commissions are far and few between, and grants are the same story. Countless companies have been built to support digital art and have collapsed. Digital artists have always struggled to have time and space to make their work. It’s the hard truth. For anyone paying attention, the last few months (even the month of January alone!) has changed everything — for the moment.

Fanny Lakoubay: The affiliation between blockchain and the art market developed in 2008 with blockchain-based artwork directories such as Verisart and Codex. But the art market had done without blockchain for centuries, and these use cases faded after the hype was over. The real revolution came with NFT technology that sublimated digital works into unique commodities. Previously, JPEGs could be copied indefinitely, but it was scarcity (or “rarity” in crypto jargon) that allowed the new market to emerge.

The blockchain’s decentralized ecosystem originally promised a more direct connection between digital artists and collectors by removing intermediaries. However, in only a few years, the discourse has developed into a “fight of the platforms,” with the focus drawn to the new gatekeepers: the marketplaces themselves rather than the artists, to OpenSea versus Rarible versus Nifty Gateway versus SuperRare.

There is still a lot to do, more volume and liquidity to achieve to reach the holy grail of peer-to-peer curation. In the meantime, platforms are seeking the help of independent curators, such as MoCDA, to surface some content.

Collecting crypto art is different for a number of core reasons: it reflects not simply a new art movement but a new art form; the multidisciplinarity of crypto artists — from graphic designers to scientists to technologists — ensures new narratives underpin the work; and it is an art of living artists, without a history to weigh it down. Yet it is also a market for early adopters and one with many issues still to resolve, most notably the high gas prices on Ethereum, the blockchain of choice for artists, which makes it costly for artists to mint and publish their works.

As far as display is concerned there is still space for innovation, especially in allowing collectors to flaunt their wares. But new business models indicate that the crypto art space is not simply looking to replicate the traditional art market on Web 3.0. The DAO format, short for “decentralized autonomous organization,” is designed to ensure fair, decentralized governance and voting. In the case of Flamingo DAO, members are required to deposit 50+ETH to invest in NFTs and build a collection alongside a team of curators. Even if traditional collectors of contemporary art revert to their comfort zone following crypto’s pandemic-induced visibility, there is no urgent need to permanently convert them given the number of new tech-savvy buyers sustaining the market.

The progress achieved in the last year in crypto is equivalent to ten years in the legacy art world. So let’s see what the new normal is. There is no going back.